At Griffin Family Law, we know what’s at stake. Led by Attorney Kent Griffin, a seasoned divorce attorney in Jacksonville with over two decades of legal experience, our firm provides personalized, strategic counsel to entrepreneurs, professionals, and business owners throughout Northeast Florida. Kent Griffin has handled complex family law matters for years, including high-asset divorce cases involving closely held businesses, professional practices, and partnerships.

Understanding the Law

Under Florida’s equitable distribution laws, even a company that feels entirely personal can be subject to division. Whether your business was started before the marriage or built during it, its value—along with any growth or appreciation—may need to be evaluated and divided in your divorce settlement. That’s why having a trusted family law firm in Jacksonville with knowledge of both legal and financial nuances is critical.

Clients consistently praise Kent Griffin for his sharp legal insight and genuine concern for their futures. As one recent client shared:

“Kent Griffin was honest, efficient, and truly cared about protecting my business and my family. I could not have asked for a better advocate during such a difficult time.”

When you choose Griffin Family Law, you’re choosing a firm that values transparency, precision, and personal service. We work directly with financial experts when necessary, ensuring that your business is accurately assessed and your rights are protected at every step.

In this guide, we’ll break down what business owners need to know about valuing a business in divorce in Florida, what the courts consider during valuation, and how to protect what you’ve built. Whether you’re dealing with a family-owned company, a solo practice, or a growing partnership, this information can help you prepare and take action.

Let’s start with one of the most critical questions: Is your business even considered marital property in Florida?

Is Your Business Marital Property Under Florida Law? Here’s What You Need to Know

Before you can determine how a business will be divided in a Florida divorce, you have to answer a critical question: Is the business marital property?

Florida follows an equitable distribution model, which doesn’t mean a 50/50 split, but rather a fair division based on several statutory factors. Determining whether a business is marital or non-marital under Florida law is a complex but essential step that directly impacts your financial future.

At Griffin Family Law, we help clients untangle these distinctions with clarity, strategy, and years of experience. Attorney Kent Griffin, a trusted Jacksonville divorce lawyer for business owners, brings decades of practical insight to the table. His approach is always grounded in Florida law, meticulous analysis, and client-focused advocacy.

Understanding Marital vs. Non-Marital Business Interests in Florida

In general, a business may be considered marital property if:

- It was founded or acquired during the marriage, regardless of whose name is on the paperwork.

- It was started before the marriage but increased in value due to the other spouse’s direct or indirect contributions.

- Marital funds were used to invest in, grow, or sustain the business.

A business may be considered non-marital property if:

- It was inherited or gifted solely to one spouse.

- It existed before the marriage and involved no significant marital contribution or financial commingling.

- There is a valid prenuptial or postnuptial agreement that designates the property as separate.

But there’s a catch—equity appreciation and active contributions can “convert” a non-marital business into marital value that must be divided. For example:

- If your spouse didn’t work for the company but helped raise children or maintain the household so you could run the business, the court might view that as an indirect marital contribution.

- If marital funds were used for payroll, equipment, or business loans—even temporarily—that commingling may make part of the business marital property.

Why This Matters in Florida Divorce Cases

The difference between marital and non-marital property can translate into tens or even hundreds of thousands of dollars during a high-asset divorce. At Griffin Family Law, we take the time to review:

- Business formation documents

- Partnership agreements

- Financial records, including ledgers, tax returns, and balance sheets

- Prenuptial or postnuptial agreements

- Evidence of personal vs. marital investment

Case Example (Hypothetical Based on Common Issues)

Let’s say a Florida couple married in 2010. One spouse opened a marketing agency in 2008. Even though the business predates the marriage, it saw explosive growth between 2010 and 2024, thanks in part to the other spouse’s support at home, networking help, or even the use of shared funds to hire staff.

In this case, the court may decide:

- The base value in 2010 remains non-marital.

- But the growth from 2010 to 2024 may be subject to equitable division.

This is where Kent Griffin’s legal strategy matters most. He helps clients navigate these blurred lines with clarity, assembling the evidence needed to draw clear boundaries between personal equity and marital gain.

From Clients Who’ve Been There

“Kent worked tirelessly to ensure my business interests were protected. He understood the financial complexity of the situation better than anyone I consulted.”

— Former Client

When it comes to valuing a business in a divorce in Florida, not every attorney has the background or skill set required to tackle it head-on. Griffin Family Law brings real-world business acumen, technical legal experience, and a commitment to personalized service that sets us apart.

How Florida Courts Value a Business During Divorce

Once a business is classified as partially or fully marital property, the next question becomes: How much is it worth? Valuing a business in a Florida divorce isn’t just a matter of examining profits or assets—it’s a multifaceted process that considers financial documents, market trends, liabilities, and even intangible assets, such as goodwill. The result can significantly impact your divorce settlement, making accurate valuation critical.

At Griffin Family Law, we take a strategic and informed approach to this process. Attorney Kent Griffin partners with financial professionals when needed and knows how to question valuations that don’t tell the whole story. His background in handling high-asset divorces across Jacksonville makes him a formidable advocate for both business owners and spouses.

Common Business Valuation Methods Used in Florida Divorce

Florida courts typically rely on one or more of the following methods to assign a value to a business:

- Asset-Based Approach: This method totals the value of all tangible and intangible assets, subtracts liabilities, and assigns the resulting number as the business’s worth. It’s most useful for companies with substantial property or inventory, such as construction firms or retail stores.

- Income Approach: This focuses on the company’s earning potential. Courts may examine past income and project future profits, then apply a discount rate to determine present value. Professional practices, such as law firms or medical clinics, often fall under this approach.

- Market Approach: This involves comparing your business to similar companies that have recently been sold in the same industry or region. It’s similar to how real estate comps work, but applying it can be challenging if no direct comparisons are available.

Each method has pros and cons, and choosing the right one often depends on:

- The type of business

- Its history and structure (LLC, sole proprietorship, partnership)

- Availability of reliable financial data

- Industry standards

What Role Do Financial Experts Play?

In high-net-worth divorces, courts often allow or appoint a forensic accountant or valuation expert to conduct an independent appraisal. These professionals may:

- Analyze tax returns, profit and loss statements, and balance sheets

- Account for depreciation and capital expenditures

- Adjust for market volatility or one-time events (such as COVID-19 revenue drops)

- Evaluate intangible assets like brand value or customer loyalty.

At Griffin Family Law, we collaborate with credentialed financial professionals to present the most accurate and supportable picture of your business’s value. Our goal is simple: ensure our clients aren’t short-changed in either direction—whether they’re defending their business or seeking a fair share of its worth.

Pitfalls and Inflated or Undervalued Figures

Business valuation in divorce is not always a straightforward or objective process. In some cases, one spouse might:

- Undervalue the business to minimize a payout

- Overstate debts or losses

- Delay the release of records

- Downplay cash income or mischaracterize profits

Kent Griffin has experience uncovering and challenging these tactics, using financial transparency and legal precision to advocate effectively.

“The thoroughness of Kent’s approach blew me away. He spotted inconsistencies in the other side’s valuation report that would’ve cost me everything. I felt 100% protected.”

— Client Review

Use the Right Professionals, Not Just the Right Numbers

It’s not just the valuation itself that matters—it’s the credibility of the process. Courts in Florida are more likely to accept a valuation when:

- A neutral or court-appointed expert performs it

- It adheres to generally accepted accounting principles (GAAP)

- It includes detailed documentation and clear methodology

By working with Griffin Family Law, you ensure that your valuation isn’t just accurate—it’s defensible. Our network of experts and Attorney Griffin’s courtroom experience bring both trust and authority to the table.

What Happens After the Business Is Valued? Your Options Under Florida Divorce Law

Once the business has been valued, the next step in your Florida divorce is determining what to do with it. Just because a company is worth a specific dollar amount doesn’t mean it must be sold or divided in half. Florida’s equitable distribution law allows courts—and spouses—to get creative when dividing assets, especially when a business is involved.

At Griffin Family Law, we understand the personal connection many clients have to their businesses. Attorney Kent Griffin works closely with business owners and professionals throughout Jacksonville to protect their interests and ensure their companies don’t become casualties of the divorce process.

Three Common Outcomes for Business Division in Divorce

Depending on your unique circumstances, here are the most common ways Florida courts or parties handle the business after valuation:

1. Buyout of One Spouse’s Interest

This is the most common resolution. One spouse retains the business and “buys out” the other spouse’s share, either through:

- A lump sum payment

- A structured settlement over time

- An offset using other marital assets (such as retirement accounts, real estate, or vehicles)

This method enables the business to remain operational without disruption, protecting its reputation and ensuring employee stability.

“Kent helped negotiate a buyout that let me keep full ownership of my company and avoid a drawn-out court fight. He understood what was at stake and never lost sight of my long-term goals.”

— Former Client

2. Selling the Business and Dividing the Proceeds

If neither party wants the business or can afford a buyout, the court may order the business sold. This can be:

- Voluntary (both parties agree to sell)

- Involuntary (court orders the sale if parties can’t agree)

Drawback: This approach can result in:

- Delays (waiting for the right buyer)

- Loss of goodwill or value in a rushed sale

- Tax consequences from asset liquidation

At Griffin Family Law, we constantly explore creative solutions to avoid forced sales, especially when it risks destroying a profitable or promising enterprise.

3. Co-Ownership Post-Divorce (Rare and Risky)

Although technically possible, co-ownership is rarely advisable unless the parties have a high level of mutual trust and clear boundaries. This setup might work when:

- Both parties already co-manage the business

- A buyout is not yet financially feasible.

- There’s a clear exit plan or agreement in place.

Even in amicable divorces, Attorney Kent Griffin advises clients to exercise caution when considering this option. Divorce often brings emotional volatility, and co-owning a business can create ongoing legal and financial entanglements that undermine finality and independence.

Factors Florida Courts Consider When Dividing the Business

Florida judges look at the whole financial picture when deciding how a business should be divided:

- Each spouse’s contributions to the business (direct or indirect)

- The business’s role as an income source

- Whether other marital assets can offset an interest in the business

- The tax consequences of a proposed division

- The best interests of any minor children involved

Because Florida is not a community property state, the court is not required to split the value equally. Instead, the focus is on fairness, which the quality of your legal representation can significantly influence.

Why Strategic Planning Matters

At Griffin Family Law, we understand that divorce isn’t just about legal paperwork—it’s about preserving your life’s work. Whether your goal is to:

- Protect your business’s future

- Receive a fair share of its value

- Avoid litigation that drains resources and goodwill

—We create custom legal strategies based on your specific goals and financial realities.

“Kent Griffin was more than my attorney—he was my partner in protecting my company and planning for the next chapter of my life.”

— Client Testimonial

Common Disputes in Business Valuation During Florida Divorce—And How to Protect Yourself

Even when both parties agree that a business is marital property and understand its general value, business valuation disputes are among the most contentious issues in a Florida divorce. Why? Because businesses are dynamic, complex, and—unlike bank accounts—not always easy to quantify.

At Griffin Family Law, we’ve helped clients uncover financial red flags, defend against underhanded tactics, and ensure accurate valuations that hold up in court. Attorney Kent Griffin’s extensive experience with high-asset divorces gives him a sharp eye for the accounting tricks and legal loopholes that can significantly shift outcomes. When your financial future is at stake, experience and vigilance matter.

The Most Common Valuation Disputes in Florida Divorce Cases

1. Hidden Income or Cash Flow Manipulation

Some business owners may attempt to:

- Underreport income

- Delay contracts or invoices until after divorce

- Overpay debts or reinvest earnings to reduce profits artificially

These tactics make the business appear less profitable than it is, potentially reducing the value used in divorce settlements.

What Kent Griffin Does: He works with forensic accountants and tax professionals to examine cash flow, trace assets, and expose irregularities in financial reporting.

2. Inflated Debts or Phantom Liabilities

One spouse may suddenly “discover” business debts—such as backdated loans or excessive operational expenses—just before valuation.

Red Flag: These so-called liabilities often don’t appear in records or were never previously disclosed to the other spouse.

Our Strategy: We scrutinize the business’s debt history and verify all liabilities with documentation. If the numbers don’t add up, we challenge them in court.

3. Overstated or Undervalued Goodwill

Goodwill refers to the intangible value of a business, including brand recognition, client loyalty, and reputation. Florida courts distinguish between:

- Enterprise goodwill (value tied to the business itself)

- Personal goodwill (value tied to the owner’s skills or relationships)

Only enterprise goodwill is typically subject to equitable distribution.

Risk: One spouse may attempt to inflate or overlook goodwill to influence the valuation.

Griffin’s Edge: We present a well-documented case that separates personal reputation from actual enterprise value, ensuring the valuation is both accurate and fair.

4. Disputes Over Documentation or Access

Sometimes, one spouse controls all business records and delays or limits access. This tactic creates power imbalances and prevents proper evaluation.

Attorney Kent Griffin’s Approach: He promptly files motions to compel full financial disclosure when necessary and ensures that no one hides behind spreadsheets.

5. Timing Disputes

Valuations can vary widely depending on when they are performed. A business may be temporarily struggling—or booming—due to external factors such as the economy or seasonal fluctuations.

Solution: Griffin Family Law examines long-term trends and trailing data, rather than focusing solely on a single year’s performance. We work to ensure that valuations accurately reflect the actual ongoing value of the business, rather than a manipulated snapshot.

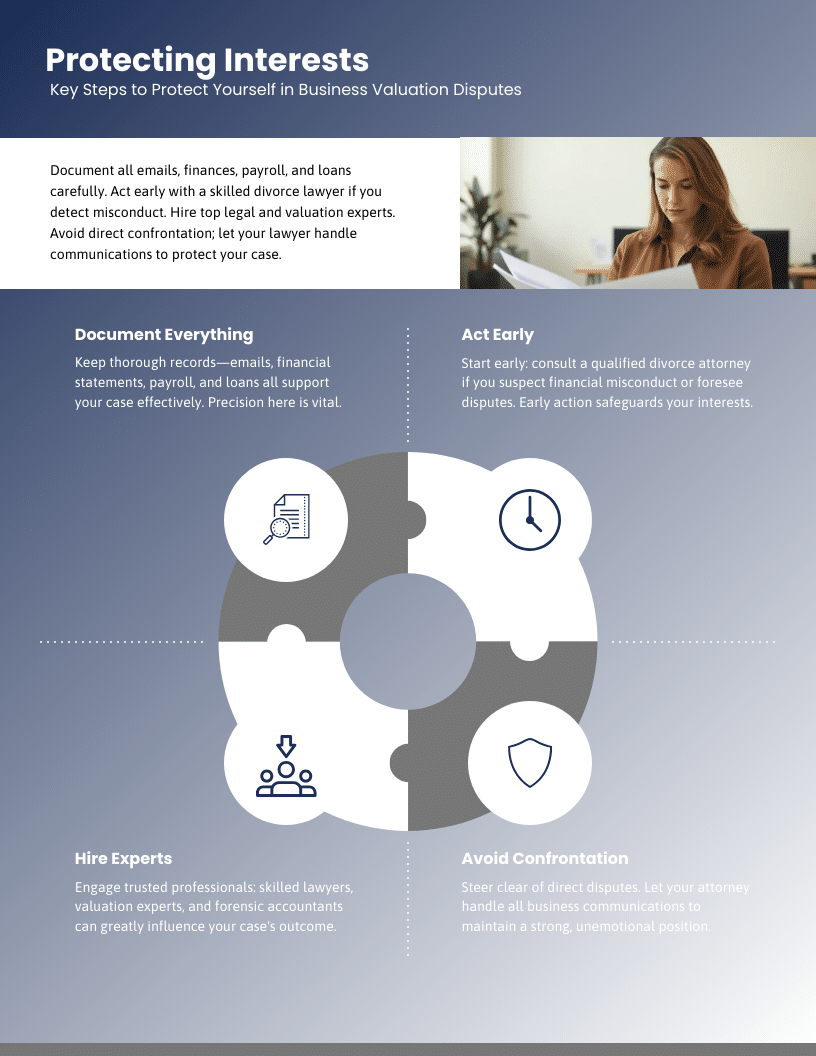

Protecting Your Interests in a Business Valuation Dispute

These disputes aren’t just theoretical—they can cost you real money, equity, and post-divorce security. To protect yourself, you need to:

- Document everything: Emails, financial records, payroll, loan agreements—these all build your case.

- Act early: If you suspect financial misconduct or anticipate resistance, involve a qualified divorce attorney before you file.

- Hire the right professionals: A strong legal team with access to reputable valuation experts and forensic accountants can turn the tide in your favor.

- Avoid confrontation: Let your lawyer handle all communications related to the business. Emotional responses can hurt your case.

Smart Strategies for Florida Business Owners Going Through Divorce

If you’re a business owner heading into divorce—or even just considering it—proactive planning can make or break your outcome. Divorce involving a business requires more than just legal filings. It demands foresight, financial clarity, and a strong legal partner who understands both the courtroom and the complexities of entrepreneurship.

At Griffin Family Law, we’ve guided countless business owners across Jacksonville through high-stakes divorce proceedings. Attorney Kent Griffin combines his deep understanding of Florida divorce law with practical, results-driven strategies designed to protect what you’ve built.

Below are essential tips every business owner should follow before, during, and after the divorce process.

1. Maintain Accurate, Clean Financial Records

Sloppy books are one of the most significant liabilities in a business valuation. Whether you’re a sole proprietor or managing a multi-member LLC:

- Keep personal and business finances strictly separate

- Update your financials monthly, including profit/loss statements and balance sheets

- Store documentation of all major transactions, debts, and investments

Why it matters: Clean records support an accurate valuation and help you refute claims of hidden income or improper deductions.

2. Don’t Make Major Business Changes During Divorce

Avoid:

- Selling business assets

- Altering ownership structures

- Taking on new debt

- Terminating key staff

Florida courts may view sudden changes as attempts to hide or diminish marital property, which can backfire.

Griffin Family Law tip: If changes are necessary for business continuity, document the reasons clearly and run them by your attorney first.

3. Get a Professional Business Valuation Early

Don’t wait for your spouse’s legal team to assign a value to your business. Commission your valuation by a neutral, court-credible expert so you’re prepared from day one.

“Kent encouraged me to secure a valuation before anything was filed—it gave me a huge advantage when negotiations began.”

— Business Owner, Jacksonville

4. Review Your Corporate Agreements

If your business has multiple owners or partners, review:

- Operating agreements

- Buy-sell agreements

- Shareholder clauses related to divorce

Some agreements may restrict transfer of ownership in a divorce or require existing partners to buy out the divorcing spouse’s share.

Attorney Kent Griffin routinely reviews these documents to ensure that legal strategy aligns with business protections.

5. Protect Your Privacy and Confidentiality

Divorce litigation can expose proprietary business information, including:

- Client lists

- Trade secrets

- Profit margins

At Griffin Family Law, we proactively request protective orders to ensure sensitive information stays out of the public record.

6. Separate Emotional Ownership from Strategic Decision-Making

It’s normal to feel deeply attached to your business. However, emotional decisions—such as refusing a buyout or fighting for full ownership at all costs—can lead to expensive and drawn-out litigation.

Kent Griffin’s counsel is rooted in strategy: “We don’t just fight to win—we fight smart. My job is to get you the best long-term result with the least damage to your business or financial future.”

7. Think Beyond the Divorce Decree

Once the divorce is finalized, your business still needs to thrive. Consider:

- Updating operating agreements to reflect new ownership

- Adjusting succession plans

- Revisiting your tax strategy and financial goals

Griffin Family Law collaborates with financial advisors and CPAs to ensure your post-divorce life is structured for success, not stress.

Whether you’re in the early stages of a Florida divorce or already into discovery, these steps can protect your company’s value, integrity, and future.

Can a Prenup or Postnup Protect Your Business in a Florida Divorce?

Absolutely—and if you’re a business owner in Florida, having a prenuptial or postnuptial agreement might be one of the smartest moves you can make to protect your company. These agreements aren’t just for celebrities or the ultra-wealthy. They’re practical tools that allow you to define what happens to your business long before divorce becomes a reality.

At Griffin Family Law, Attorney Kent Griffin regularly advises business owners, professionals, and high-net-worth individuals in Jacksonville on how to use marital agreements to shield their most valuable assets. If you already have a business—or plan to start one—Kent can help you create a solid, enforceable agreement that reflects your goals and secures your future.

What Is a Prenup or Postnup?

- A prenuptial agreement is a contract signed before marriage that outlines how assets (including a business) will be treated in the event of divorce.

- A postnuptial agreement is the same type of contract, but it’s created after marriage.

Both documents can:

- Identify a business as separate, non-marital property

- Establish how business growth, income, or debt will be treated

- Outline buyout provisions if one spouse becomes involved in the business

- Limit or eliminate claims to future appreciation of the business

Why They Matter in Divorce

Under Florida law, without a prenup or postnup, any increase in a business’s value during the marriage may be subject to equitable distribution, even if the business was founded before the marriage. This means your spouse could be entitled to a percentage of:

- Profits reinvested into the company

- Client growth or market expansion

- Increased goodwill or branding recognition

With a carefully drafted agreement, you can avoid this outcome and keep your business from becoming marital property.

What If You Don’t Have One?

Even without a prenup or postnup, you still have options. Attorney Kent Griffin:

- Examines corporate formation documents and financial history

- Identifies and separates pre-marital vs. marital contributions

- Structural settlements that minimize business disruption and ownership dilution

Griffin Family Law can also help you create a postnuptial agreement now—even if divorce isn’t on the horizon. For business owners seeking clarity, protection, and peace of mind, it’s a proactive and practical solution.

Florida Law & Enforceability

For a prenup or postnup to be enforceable in Florida, it must:

- Be in writing and signed by both parties

- Include complete and fair disclosure of financial information.

- Be entered into voluntarily, without coercion or duress

- Not be “unconscionable” (grossly unfair at the time of enforcement)

Kent Griffin has the legal skill and negotiation awareness to draft agreements that hold up in court and reflect the real-world needs of business owners.

Whether you’re already navigating divorce or planning for the future, Griffin Family Law provides strategic guidance that aligns with your business and personal goals.

Why Business Owners Trust Griffin Family Law in High-Asset Florida Divorce Cases

Not every divorce attorney is equipped to handle the complex financial and legal challenges that come with dividing a business. At Griffin Family Law, we go beyond the basics—delivering personalized, strategic representation tailored to the unique needs of business owners and high-net-worth individuals in Jacksonville and throughout Northeast Florida.

Led by Attorney Kent Griffin, our firm has earned a reputation for providing high-level advocacy with integrity, precision, and discretion. Whether you’re protecting a lifelong enterprise, negotiating fair terms, or navigating hidden asset concerns, we bring the clarity and confidence you need during a profoundly personal and financially complex time.

Understanding of Business and Family Law

Attorney Kent Griffin brings over two decades of legal experience in complex family law matters, including:

- Business valuations involving professional practices and LLCs

- Negotiating asset division with financial experts and forensic accountants

- Representing entrepreneurs, executives, doctors, and small business owners

- Crafting agreements that preserve businesses during and after divorce

Kent’s clients appreciate his calm yet commanding approach. He’s analytical where it counts, empathetic when it matters, and relentlessly focused on outcomes.

Personal Attention, Strategic Solutions

Unlike large firms where you’re passed off to junior associates, Kent Griffin works directly with every client—from initial consultation to final judgment. That personal connection means:

- Your goals shape the legal strategy

- You get prompt, direct answers to your questions

- Your business is handled with confidentiality and care

At Griffin Family Law, we treat every case as if it’s the most important case—because to you, it is.

Local Insight That Matters

Based in Jacksonville, we understand:

- Duval County courts and Northeast Florida judicial preferences

- Regional business trends, valuation norms, and common partnership structures

- Local financial experts, appraisers, and industry professionals

This local authority enhances our ability to provide court-ready documentation, persuasive arguments, and informed negotiation tactics that get results.

When your business and financial future are on the line, you need more than just a lawyer—you need a strategist, a guide, and a protector. That’s what Griffin Family Law offers.

Protect What You’ve Built—Start with the Right Divorce Strategy

At Griffin Family Law, we understand that your business isn’t just another asset—it’s a reflection of your work, vision, and financial security. Attorney Kent Griffin brings clarity to complexity, offering business owners in Jacksonville the trusted legal support they need to navigate high-asset divorce with confidence.

Key Takeaways:

- Florida uses equitable distribution laws, meaning your business could be subject to division—even if you started it before marriage.

- Accurate, court-defensible business valuation is essential for a fair settlement.

- Common disputes—like hidden income, inflated debts, and access to financials—can be avoided or mitigated with strong legal guidance.

- A prenup or postnup can offer powerful protection, but if you don’t have one, legal strategy still matters.

- Working with an experienced, trusted Jacksonville divorce attorney like Kent Griffin can make the difference between preserving your life’s work and losing control over it.

Schedule a Consultation Today

If you’re a business owner considering divorce—or already facing one—don’t leave the future of your company to chance. Let Griffin Family Law guide you with personalized strategy, deep legal knowledge, and a commitment to protecting what you’ve built.